The consumer price, a key measure of inflation, rose 0.4% in February, up 6% from February 2022, the U.S. Bureau of Labor Statistics reported on Tuesday. An economist connected this persistent inflation and the crisis surrounding Silicon Valley Bank to the Biden administration’s policies.

“Over the past week, we have witnessed more fallout from the federal government spending, borrowing, and printing trillions of excess dollars than over the previous several years. Not only did artificially low interest rates stoke inflation, but they also have facilitated a potential banking crisis,” EJ Antoni, a research fellow for regional economics in the Center for Data Analysis at The Heritage Foundation, said in a statement after the report’s release.

“The government’s new bailout of irresponsible financial institutions is further complicating the Federal Reserve’s belated fight against inflation. We are witnessing in real time how misguided government intervention in the marketplace has side effects worse than the original disease. Instead of allowing that same marketplace to return to regular working order, the government continues applying ‘cures’ with harmful side effects,” Antoni said.

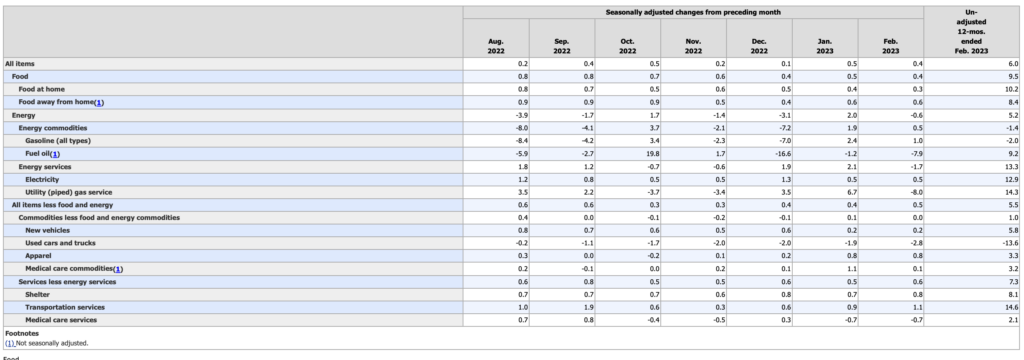

The shelter index rose 0.8%, food index rose 0.4%, the transportation services index rose 1.1%, and the gasoline index rose 1.0%, while the fuel oil index decreased 7.9%, the utility (piped) gas service index decreased 8.0%, the energy index decreased 0.6%, and the used car and trucks index decreased 2.8%, the Bureau of Labor Statistics reported.

Ahead of the report, economist were expecting that inflation rose by 0.4% in February and a year-over-year rate of 6%, CNBC reported.

Jerome Powell, chair of the Federal Reserve, appeared before the Senate Banking, Housing, and Urban Affairs Committee last Tuesday.

“My colleagues and I are acutely aware that high inflation is causing significant hardship, and we are strongly committed to returning inflation to our 2 percent goal. Over the past year, we have taken forceful actions to tighten the stance of monetary policy,” Powell said. “We have covered a lot of ground, and the full effects of our tightening so far are yet to be felt. Even so, we have more work to do.”

“Our policy actions are guided by our dual mandate to promote maximum employment and stable prices. Without price stability, the economy does not work for anyone,” he said. “In particular, without price stability, we will not achieve a sustained period of labor market conditions that benefit all.”

Powell added:

Although inflation has been moderating in recent months, the process of getting inflation back down to 2% has a long way to go and is likely to be bumpy.

The January consumer price index rose 0.5%, up 6.4% from January 2022, The Daily Signal previously reported.

Antoni previously blamed both Republicans and Democrats for their “overspending” after the federal government revised inflation numbers upward for the January 2023 report on price increases.

“Not only was January’s inflation number hotter than expected, but the last three months of 2022 were also revised upwards,” Antoni said. “That means inflation has not cooled as much as originally estimated.” (The Daily Signal is Heritage’s multimedia news organization.)

“The Federal Reserve was premature in its decision to slow its interest rate hikes,” Antoni added. “Further evidence of this is the fact that national financial conditions continue loosening, not tightening. We have a long way to go before the Fed closes this Pandora’s Box, which they opened.”

Antoni added:

This is not an issue of politics but policy. Both Republicans and Democrats have been complicit in overspending and both parties must rein in the monster they’ve created.

December’s consumer price index was initially reported as having decreased 0.1%, which was up 6.5% from December 2021, according to the Bureau of Labor Statistics.

However, the bureau revised the consumer price index for December upward to an increase of 0.1%, rather than a decrease of 0.1% as initially reported, Reuters reported on Feb. 10. The consumer price index for November was also revised from an increase of 0.1% to 0.2% as was the consumer price index for October, which was updated from an increase of 0.4% to 0.5%.

The consumer price index for February will be released April 12.

This is a breaking story and may be updated.

Have an opinion about this article? To sound off, please email letters@DailySignal.com and we’ll consider publishing your edited remarks in our regular “We Hear You” feature. Remember to include the url or headline of the article plus your name and town and/or state.

The post Biden’s Policies Responsible for Persistent Inflation, ‘Potential Banking Crisis,’ Economist Says appeared first on The Daily Signal.

- JOSH HAMMER: Mob Rule Is Taking Over The West - April 2, 2023

- JUDGE ANDREW P. NAPOLITANO: Trump Can Be His Own Worst Enemy - April 2, 2023

- SHOSHANA BRYEN: Here’s What Really Lies Behind The Biden Admin’s Icy Israel Relationship - April 1, 2023

JOIN US @NewRightNetwork on our Telegram, Twitter, Facebook Page and Groups, and other social media for instant news updates!

New Right Network depends on your support as a patriot-ran American news network. Donate now