As Congress debates a deal to increase the debt limit, here are four things Americans should know:

1. Immediate spending reduction in Biden-McCarthy deal is infinitesimal; long-term reductions are small and uncertain. Faced with a $1.571 trillion deficit next year, and $20.3 trillion in deficits over the next 10 years, the deal brokered by President Joe Biden and House Speaker Kevin McCarthy includes only $12 billion (that’s $0.012 trillion) in spending reductions next year.

Moreover, the roughly $1.3 trillion in alleged cuts over the 10-year horizon represent only 1.7% of total spending and are not guaranteed as future Congresses could waive or amend many of the reductions.

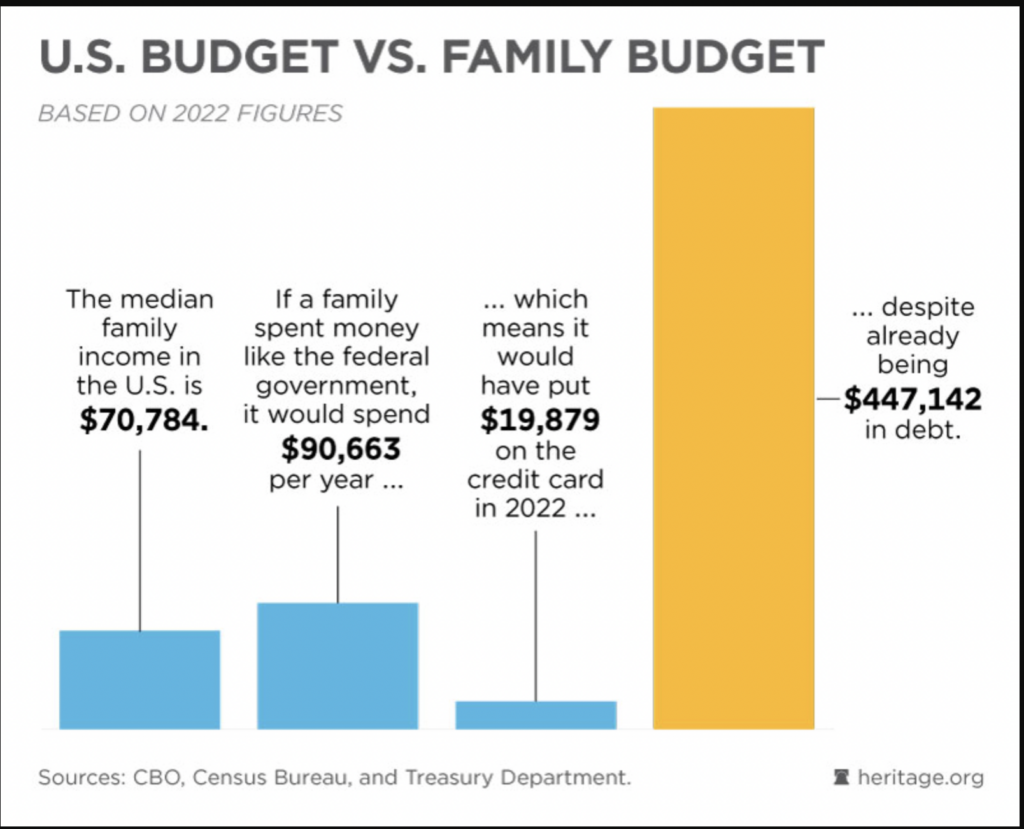

Trillions are truly incomprehensible, but to put these numbers in perspective, the median family income in the U.S. was about $70,784 in 2021. If that family spent like the federal government, they would spend $19,879 more than they earned next year. And they’d spend $276,000 more than they earn over the next 10 years.

Surely no mortgage lender nor credit card company would readily lend to a household with this fiscal trajectory. And they’d likely laugh if the household submitted a “fiscally responsible” proposal that required them to shave only $173 out of their budget next year and reduce their amount of new debt by only $18,000 out of $276,000.

2. Suspension is a blank check on new spending that Americans can’t afford. The difference between a dollar amount increase in the debt limit and a two-year suspension in the debt limit is the difference between giving someone a gift card for, say, $500, versus giving them your credit card for a month.

Whereas a specific dollar amount incentivizes the recipient to prioritize their spending to stretch the gift card out as long as possible, a specific time period of unlimited borrowing incentivizes the recipient to borrow as much as possible as quickly as possible.

While certain accounts might be subject to spending limits, the bill does not prevent Congress from creating entirely new programs and giveaways.

3. Nothing to prevent or even deter crony giveaways. Mere weeks before the federal government hit the current debt limit in January, the Pension Benefit Guaranty Corporation approved a $35.8 billion taxpayer bailout of the Central States Pension Fund, which provides benefits to Teamster union members. Although that particular plan was once under federal conservatorship as a result of its involvement in the mafia, it and the 100+ other plans that are receiving taxpayer bailouts are private union pension plans for which taxpayers have no obligation.

Just as ordinary Americans can’t tap into the U.S. Treasury if they fail to save as much as they’d like in their 401(k) retirement accounts, taxpayers should not be responsible for the broken pension promises of private sector unions and employers.

Had policymakers faced tighter spending constraints, they might have actually addressed the root problems that led to private union pensions promising $677 billion more in pension benefits than they set aside to pay, but instead, they just opened the spigots to taxpayer bailouts.

4. Democrat policies and poor governance—not the Limit, Save, Grow Act—deprive veterans. One of Democrats’ tactics to demonize the Limit, Save, Grow Act was to wrongly claim that it included 22% cuts to veterans health care. But nothing in the Act required such cuts.

Rather, the Biden administration’s actions and unaccountable governance at the Department of Veterans Affairs have deprived veterans of health care. In 2018, the Trump administration banned medical professionals at the VA (more than 100,000 of them) from shirking their duties to treat patients and instead working for their employee union—sometimes full-time—through a practice known as “official time.”

The Biden administration revived official time for medical professionals at the VA, and used significant VA resources to retroactively pay VA employees for time they spent working for their union instead of treating veterans during the three years that the practice was banned.

Moreover, bad governance and an utter lack of accountability have deprived veterans of medical care. Just two of the VA’s programs—long-term services and supports and community care—wasted $2.7 billion on improper payments last year. The long-term services program routinely spends more than half of its funds improperly.

With $245 billion of improper payments issued by the federal government last year alone, there is plenty of room to significantly reduce spending without actually cutting benefits to programs’ intended recipients.

It’s not only possible, it’s vitally imperative that Congress immediately stop its reckless runup in spending and address the federal government’s irrefutably unsustainable fiscal trajectory. The Heritage Foundation’s Budget Blueprint provides more than 200 policy recommendations that would bring federal spending in line with federal revenues by restoring the federal government to its proper role. (The Daily Signal is the news outlet of The Heritage Foundation.)

The Limit, Save, Grow Act was a modest step towards fiscal responsibility, but the Biden-McCarthy deal is a vastly watered-down version of that proposal. Regardless of where policymakers settle in this current debt limit debate, policymakers will still have significant work to do in preventing fiscal calamity and to restore fiscal sanity.

The post 4 Things to Know About Debt Limit Debate appeared first on The Daily Signal.

- The Sneaky Way Deep-State Bureaucrats Advocated Censorship of Americans in 2020 - November 13, 2023

- There Is No ‘Second America’ if This One Fails - November 13, 2023

- ‘Zero Appetite’ in Israel for Cease-Fire With Hamas, Embassy Official Says - November 13, 2023

JOIN US @NewRightNetwork on our Telegram, Twitter, Facebook Page and Groups, and other social media for instant news updates!

New Right Network depends on your support as a patriot-ran American news network. Donate now