- New taxes on energy firms in the Senate Democrats’ climate package may make life impossible for many independent U.S. oil and gas producers, according to industry experts.

- “There are multiple technical problems with not just the methane fee but with the federal onshore provisions that raise serious implementation issues,” Kathleen Sgamma, president of the Western Energy Alliance, told the Daily Caller News Foundation.

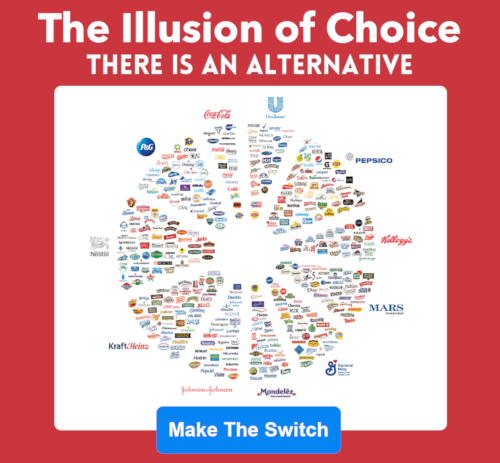

- “The entire climate agenda seeks to impose steep regulations on American industry so that the only possible way a company can survive in the long term is to be massive and be able to afford the best lobbyists and lawyers in order to influence legislation and absorb the increasing costs,” Marc Morano, publisher of Climate Depot and former U.S. Senate senior staffer on the Environment & Public Works Committee, told the DCNF.

The proposed new taxes and fees on energy firms in the comprehensive climate package passed by Senate Democrats on Sunday may make life impossible for many independent U.S. oil and gas producers, according to industry experts.

The “Inflation Reduction Act” includes a methane emissions charge that will be the first direct federal charge or tax on methane emissions. Furthermore, the act doubles rental fees on onshore leases, imposing a new fee to nominate land to be leased, and increases onshore royalty rates to nearly 17% from 12.5% under the previous administration.

Such measures included in the Senate Democrats’ $369 billion climate spending package may suffocate the nation’s 9,000 independent oil and natural gas explorers, industry groups and experts told the Daily Caller News Foundation.

“There are multiple technical problems with not just the methane fee but with the federal onshore provisions that raise serious implementation issues,” Kathleen Sgamma, president of the Western Energy Alliance, a trade organization representing independent oil and gas organizations, told the Daily Caller News Foundation. “The language on the methane tax is confusing…I think Senator Manchin was trying to exempt small companies, but the language is so convoluted I’m not sure it does.”

Independent producers of oil and gas develop 91% percent of the wells in the United States that produce 83% of America’s oil and 90% of America’s natural gas, according to the Independent Petroleum Association of America. The small producers account for 3% of the U.S. GDP and employ roughly 4 million total workers.

“Very large companies like Shell and BP have been bending over backward to say nice things about the bill … but in the face of a bad bill that suppresses American energy production and keeps prices high for consumers, groveling doesn’t improve their ESG scores, and only encourages anti-oil-and-gas politicians to pass more adverse legislation in the future,” Sgamma added.

The bill also reinstates the Hazardous Substance Superfund Financing Rate on crude oil and imported petroleum products at 16.4 cents per barrel, indexed to inflation. The law generates around $25 billion in taxes over the next ten years by reintroducing the 27-year-old tax on crude oil and other petroleum products imported into the country for consumption, use, or storage.

The previous Superfund tax on crude oil was roughly 9.7 cents per barrel and expired in 1995.

“The Democrats’ climate bill seeks to empower the bigger companies who all bow down to the woke climate agenda,” Marc Morano, publisher of Climate Depot and former U.S. Senate senior staffer on the Environment & Public Works Committee, told the DCNF. “The entire climate agenda seeks to impose steep regulations on American industry so that the only possible way a company can survive in the long term is to be massive and be able to afford the best lobbyists and lawyers in order to influence legislation and absorb the increasing costs.”

The taxes and fees in the bill could add to the methane standards that the Environmental Protection Agency (EPA) is expected to propose later this year. The charges will push operators to reduce their methane emissions before the EPA’s final rules can be fully implemented nationwide and will also crack down on methane emissions from sources that are not covered by EPA rules, such as offshore sources and LNG import and export terminals, according to the bill’s text.

“It relies on companies following both EPA rules that have not yet been proposed and state implementation plans that will take years to get approved once the EPA rule is finalized,” Sgamma said. “In the meantime, companies will have to pay the tax.”

“Another key goal is to continue to increase central planning and eliminate small and independent businesses to make it easier to get compliance,” Morano said.

The bill will also force oil companies to pay more for drilling on federal land and block them from stockpiling leases, according to the bill’s text. Additionally, the financial penalties for methane emissions that exceed federal limits will begin in 2024.

“Many people dislike big oil so it is an easy political target; however, the public may not realize how much of the industry is actually the thousands of companies that qualify as small businesses,” Ben Lieberman, a senior fellow at the competitive enterprises, told the DCNF.

“The little guys get swept up in the push to stick it to big oil,” he concluded.

Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@dailycallernewsfoundation.org.

Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@dailycallernewsfoundation.org.

JOIN US @NewRightNetwork on our Telegram, Twitter, Facebook Page and Groups, and other social media for instant news updates!

New Right Network depends on your support as a patriot-ran American news network. Donate now